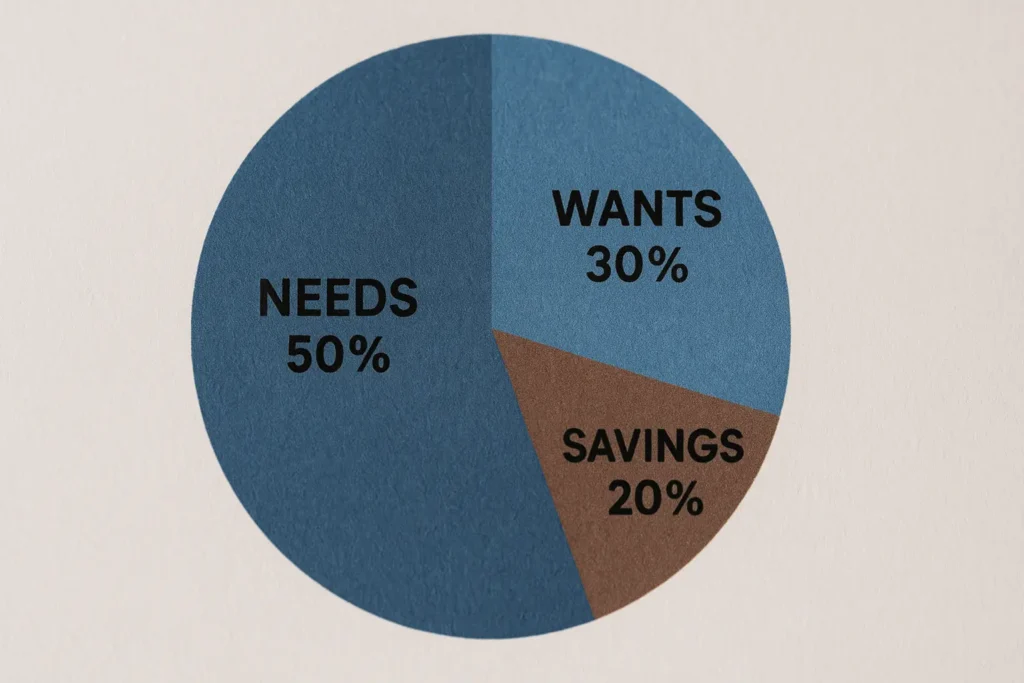

The 50/30/20 rule of budgeting is one of the simplest ways to manage money. You divide your monthly take-home income into three clear parts:

- 50% for Needs – rent, groceries, utilities, insurance, transport.

- 30% for Wants – shopping, dining out, streaming, leisure.

- 20% for Savings & Debt – emergency fund, SIPs/401(k), loan repayments.

Use the 50/30/20 calculator below (₹/$) to instantly see your budget split.

This method works whether you’re in India, the US, the UK, Canada, or Australia.

To take it further:

- Optimize tax deductions with the Tax Saving Estimator.

- Grow long-term wealth with the SIP & Lumpsum Calculator.

- Track loans and repayments with the EMI Calculator.

Quick takeaway: Budgeting doesn’t have to be complex. With the 50/30/20 rule, you gain control, cut overspending, and build savings—without spreadsheets or stress.

50/30/20 Budget Calculator (₹ / $)

50/30/20 Budget Calculator

Tip: In India, consider directing the 20% toward EPF/ELSS/SIP. If you have loans, allocate part of the 20% to debt payoff. Optimize taxes with our Tax Saving Estimator.

What Counts as Needs, Wants, and Savings/Debt (with India & Global Examples)

The beauty of the 50/30/20 rule lies in its simplicity—but the biggest confusion for beginners is deciding what goes under Needs, Wants, and Savings/Debt. Misclassifying expenses can completely throw off your budget, so let’s break it down with practical examples for both Indian and global households.

1. Needs (50% of Income)

These are non-negotiable essentials you must cover to maintain a basic standard of living. If you stop paying for these, your life or livelihood is directly affected.

Examples in India:

- Housing: Rent, home loan EMI (minimum payment only)

- Utilities: Electricity, water, LPG, mobile recharge, broadband

- Groceries & Essentials: Daily household groceries, milk, vegetables, medicines

- Transport: Fuel, metro pass, Ola/Uber for work commute

- Education: School fees, exam fees for children

- Insurance Premiums: Health insurance, term life insurance

Examples Globally (US, UK, Canada, Australia):

- Mortgage or rent payments

- Utilities (electricity, water, heating, broadband)

- Groceries and medical essentials

- Childcare, daycare, or basic education

- Public transport or fuel for work commute

- Health, home, or car insurance premiums

Pro Tip: If your Needs exceed 50%, you’re likely living in a high-cost city or carrying high-interest loans. In such cases, track EMI affordability with our EMI Calculator to see if refinancing or a balance transfer can help reduce costs.

2. Wants (30% of Income)

Wants make life enjoyable, but they’re not essential for survival. They are the extras that add comfort, fun, and lifestyle value. The challenge? Many people mistake luxuries for necessities.

Examples in India:

- Eating out at restaurants, food delivery apps (Swiggy/Zomato)

- OTT subscriptions (Netflix, Disney+ Hotstar, Prime)

- Shopping for clothes, accessories, and gadgets beyond basics

- Leisure travel and weekend getaways

- Upgrades: Premium smartphones, brand-new bike/car models

Examples Globally:

- Dining out, Starbucks runs, takeaways

- Streaming subscriptions and gaming services

- Fashion shopping, branded electronics

- Vacations, cruises, and luxury trips

- Upgrades to latest gadgets, cars, or home décor

Pro Tip: Wants should never exceed 30%. If they do, you’re sacrificing long-term financial security. A budget planner can help you track lifestyle spends and rebalance.

3. Savings & Debt (20% of Income)

This is the wealth-building and financial protection bucket. The 20% ensures your future self is safe, debt-free, and financially independent.

Examples in India:

- Savings & Investments: SIP in mutual funds, ELSS for tax saving, PPF, RD, FD laddering

- Debt Repayments: Extra loan EMIs beyond minimum, credit card bill repayment in full

- Retirement: EPF, NPS contributions, voluntary PF top-ups

- Emergency Fund: 3–6 months of living expenses in liquid assets

Examples Globally:

- Savings & Investments: 401(k), Roth IRA, index funds, ETFs

- Debt Repayments: Paying off student loans, mortgages faster, clearing credit card balances

- Emergency Fund: Cash savings for job loss or emergencies

- Retirement: Employer pension plans, superannuation in Australia, RRSP in Canada

Pro Tip: To maximize this 20%, first clear high-interest debt, then build an emergency fund, and finally, automate investments. For Indian taxpayers, start with our Tax Saving Estimator and track retirement savings using the EPF Calculator.

Quick Comparison Table

| Category | India Examples | Global Examples |

|---|---|---|

| Needs (50%) | Rent, EMI, groceries, utilities, school fees | Mortgage, utilities, childcare, insurance |

| Wants (30%) | Swiggy/Zomato, OTT, shopping, leisure travel | Dining out, subscriptions, vacations |

| Savings/Debt (20%) | SIPs, EPF, PPF, extra loan EMI, tax saving | 401(k), IRA, ETFs, loan prepayments |

Key Insight: Misplacing expenses is the most common budgeting error. Always remember:

- If it’s essential to survive or work, it’s a Need.

- If it’s optional and nice-to-have, it’s a Want.

- If it’s future-focused, it belongs in Savings/Debt.

How to Use the 50/30/20 Rule (Step-by-Step)

The 50/30/20 rule is simple, but to make it effective you need to follow a clear process. Here’s how to apply it to your own finances:

1. Identify Your Net Monthly Income

Work with your net (post-tax) salary or business income—this is the amount that actually lands in your bank account. Using gross income can give you an unrealistic picture of what you can spend and save.

2. List Fixed Bills and Tag Them as “Needs”

Start by writing down all your fixed monthly expenses such as rent, groceries, electricity, internet, insurance premiums, and minimum EMI payments. These are your essentials (50%) that you cannot skip.

3. Set a Cap for “Wants” (30%)

Decide how much you’re willing to spend on non-essentials like eating out, streaming subscriptions, travel, and shopping. Capping this at 30% of income ensures your lifestyle spending doesn’t eat into savings.

4. Automate Savings (20%) on Salary Day

As soon as you receive your income, transfer 20% into savings or investments before you spend a rupee or a dollar. This way, you’re paying yourself first instead of saving “what’s left.”

A great way to automate this is through Systematic Investment Plans (SIPs).

Plan your SIPs with our SIP & Lumpsum Calculator.

5. Review Weekly and Adjust Caps as Needed

Check your progress every week. If you find you’re overspending on “Wants,” trim back and redirect funds to Savings. The key is flexibility—life changes, so your budget should too.

Example Budgets (₹ & $)

India Example

- Monthly Income: ₹60,000

- Needs (50%): ₹30,000

- Wants (30%): ₹18,000

- Savings/Debt (20%): ₹12,000

Here, the ₹12,000 could be split between SIPs, emergency fund contributions, and loan prepayments.

US Example

- Monthly Income: $4,000

- Needs (50%): $2,000

- Wants (30%): $1,200

- Savings/Debt (20%): $800

The $800 can go into 401(k) contributions, emergency savings, or debt repayment, depending on priorities.

When the 50/30/20 Rule Doesn’t Fit (and What to Do)

The 50/30/20 rule is a great starting point, but real life isn’t always so neatly divided. Your living costs, debt obligations, or irregular income may require a different balance. The good news? You can adapt the framework without losing control of your money.

1. High-Rent Cities: Shift to 60/20/20

If rent and utilities take up more than half your income, increase your Needs category to 60% and reduce Wants to 20%. Keep the Savings/Debt portion steady at 20% so your long-term financial health isn’t compromised.

2. Heavy Debt: Try 50/20/30

When loans and credit card bills weigh you down, flip the ratio. Dedicate 30% to Savings/Debt repayment by cutting discretionary spending to 20%. Focus on clearing high-interest balances first.

- Check true affordability with our EMI Calculator before taking or restructuring loans.

- Already paying high interest? Compare and switch using the Loan Balance Transfer Checker.

3. Irregular Income: Base on Last Month

Freelancers and commission-based earners often face fluctuating paychecks. Instead of guessing, budget this month based on last month’s earnings. Keep a larger emergency buffer so you’re covered in lean months.

Save Smarter: Tactics to Hit the 20%

Even if you adjust the percentages, the 20% for savings and debt repayment remains your engine for financial progress. Here’s how to make it work:

- Automate Transfers and SIPs on Salary Day

Set up standing instructions so part of your income directly flows into investments or debt repayment before you spend a single rupee or dollar. - Build a 3–6 Month Emergency Fund

Your first savings goal should be stability. Keep three to six months of living expenses aside before investing aggressively. - Optimize Taxes to Boost Take-Home Savings

The less you pay in unnecessary taxes, the more you can save. Explore eligible deductions and tax-saving instruments with our Tax Saving Estimator. - Think Long-Term: Retirement Planning

In India, don’t overlook the power of compounding in your Employees’ Provident Fund (EPF). Track your maturity value and future corpus using our EPF Calculator.

Common Mistakes to Avoid

Even though the 50/30/20 rule is simple, many beginners fall into the same traps. Avoiding these mistakes can make the difference between a budget that works and one that collapses after a few months.

1. Counting Discretionary Subscriptions as “Needs”

It’s tempting to classify your Netflix, Spotify, or premium gym membership as a “need,” but in reality, these fall under wants. Needs are essentials like rent, food, and basic utilities. Misclassifying wants as needs inflates your “must-spend” category and squeezes out savings.

- Quick fix: Keep a clear distinction—if you can pause or cancel it without threatening your survival, it’s a want.

2. Saving “What’s Left” Instead of Saving First

Many people pay their bills, indulge in wants, and then try to save what’s left—usually, there isn’t much left. This habit kills consistency.

- Quick fix: Automate savings on salary day. Set up an SIP (Systematic Investment Plan) or a standing instruction so that your 20% savings are locked in before you spend a rupee or dollar.

3. Ignoring Insurance and Emergency Funds

Skipping insurance or not building an emergency fund is like leaving your house unlocked. One medical emergency or job loss can wipe out years of effort.

- Quick fix: Allocate part of your 20% savings to health insurance, term insurance, and at least 3–6 months of expenses in an emergency fund. Once that’s in place, channel the rest into investments.

4. Not Reviewing After Major Life Changes

Life doesn’t stay static—marriage, a new baby, home loan, or job switch will all change your expense patterns. If you stick to the same budget, it will soon feel outdated and restrictive.

- Quick fix: Recalculate your budget whenever a big change occurs. Use tools like the EMI Calculator to understand how new loans affect your needs, or the Tax Saving Estimator to update deductions after a salary hike.

Frequently Asked Questions

1. Should I use gross income or net income for the 50/30/20 rule?

Always use net (take-home) income—the amount left after taxes and deductions. This gives you a realistic picture of how much money is actually available for spending and saving.

2. Can I customize the 50/30/20 split?

Yes. The 50/30/20 rule is a guideline, not a fixed law. If you live in a high-rent city, your “Needs” may be closer to 60%. If you’re paying off debt aggressively, your “Savings/Debt” portion may go up to 30–40%. Adjust the split to fit your financial situation.

3. Where should the 20% savings go first?

Start with an emergency fund (3–6 months of expenses). After that, focus on high-interest debt repayment like credit cards or personal loans. Once debt is under control, direct the 20% toward investments such as SIPs, index funds, or retirement accounts.

4. Does EMI count under Needs or Savings/Debt?

- Minimum EMI (the amount required to keep the loan current) falls under Needs.

- Extra loan prepayments count as Savings/Debt, since they reduce future obligations.

5. How do I budget with fluctuating income?

If your income varies each month, base your budget on last month’s average earnings. Keep a larger buffer in your emergency fund to cover slow months. Freelancers and gig workers often use a “low-income baseline” budget and save the surplus during higher-earning months.

6. What if my expenses exceed 50% of my income?

If Needs consistently cross 50%, trim Wants first. Consider cheaper housing, cutting subscriptions, or cooking at home. If reducing costs isn’t possible, temporarily adjust the split (e.g., 60/25/15) until your income increases.

7. Should insurance be part of the 50/30/20 budget?

Yes. Essential insurance (health, life, vehicle, term insurance) is a Need because it protects your family and finances. Without it, even a single emergency could wipe out your savings.

8. Do I really need an emergency fund if I already invest?

Absolutely. An emergency fund is separate from investments. Investments may be locked or volatile in the short term, while emergency funds are liquid and available instantly. Aim for 3–6 months of expenses in a savings account or liquid fund.

9. How often should I review my budget?

Review your budget every 3–6 months or whenever a major life event occurs (new job, marriage, baby, relocation). Needs and priorities shift over time, and your budget should evolve with them.

10. What are the most common mistakes in applying the 50/30/20 rule?

- Counting luxuries as Needs (e.g., premium subscriptions).

- Skipping insurance and emergency savings.

- Not adjusting the rule after salary hikes, job loss, or lifestyle changes.

- Treating savings as optional instead of a fixed priority.