Life has a way of throwing surprises at us—sometimes good, but often costly. A sudden medical bill, job loss, or even a broken appliance can derail your finances if you aren’t prepared. This is where an emergency fund becomes your safety net. It’s not just about saving money—it’s about protecting your future and reducing stress when life doesn’t go as planned.

For beginners, building an emergency fund might sound overwhelming, especially if you’re already juggling bills and expenses. But the truth is, you don’t need to set aside a huge amount all at once. With a step-by-step plan and a few smart money habits, anyone can start small and grow their fund over time.

Tip: If you’re still figuring out how much of your income should go toward savings, check out our guide on the 50/30/20 Rule Explained. It’s a simple framework that helps you split income into needs, wants, and savings.

In this blog, we’ll break down exactly how much to save, where to keep your fund, and the mistakes to avoid, so you can take control of your finances with confidence.

What is an Emergency Fund and Why Do You Need One?

An emergency fund is a dedicated cash reserve that you set aside to cover unexpected expenses. Think of it as a safety net — money you can quickly access when life throws surprises like a medical bill, car repair, or sudden job loss. Unlike regular savings, this fund is meant only for emergencies, not for vacations or shopping.

Having an emergency fund provides several powerful benefits:

- Prevents Debt: Instead of relying on credit cards or personal loans, you can use your emergency savings to handle urgent expenses. This helps you avoid high interest charges and keeps your finances stable.

- Reduces Stress: Knowing you have a financial cushion gives you peace of mind. Even if something goes wrong, you won’t feel the pressure of scrambling for money.

- Builds Long-Term Stability: An emergency fund is the foundation of good financial health. It allows you to focus on future goals like investing, buying a home, or retirement without fear of setbacks.

For more practical advice on building strong financial habits, check out our guide on Top 25 Personal Finance Tips Everyone Should Know.

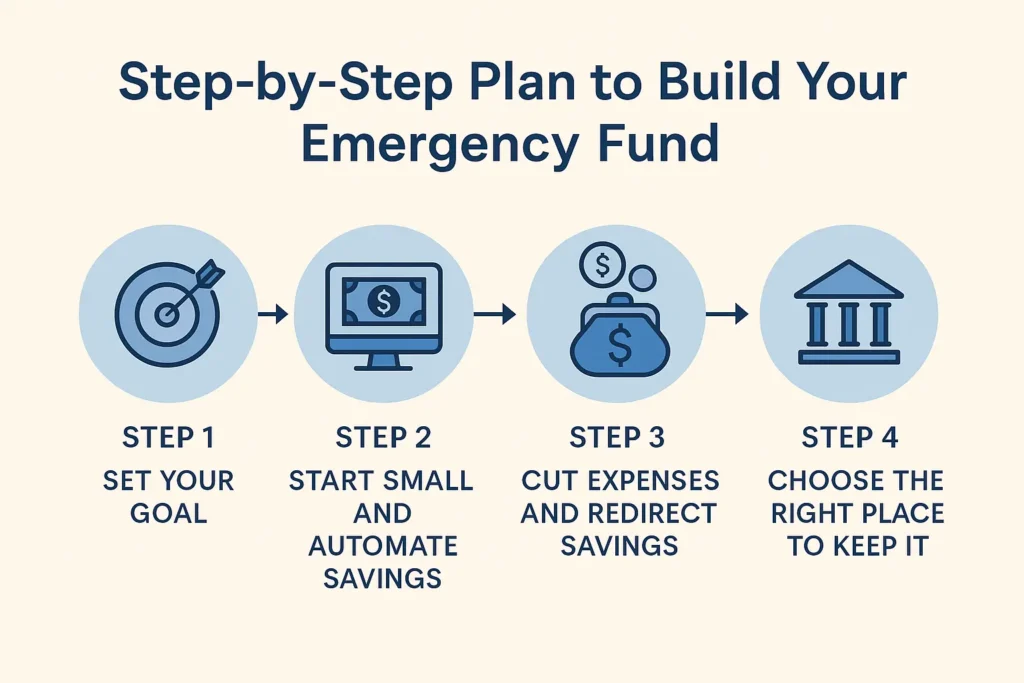

Step-by-Step Plan to Build Your Emergency Fund

Building an emergency fund might feel overwhelming at first, but breaking it into simple steps makes it manageable. Here’s a practical roadmap you can follow.

Step 1 – Set Your Goal

The first step is knowing how much you need to save. A good rule of thumb is to keep 3–6 months of your essential expenses aside.

- Start by calculating your monthly rent, groceries, utilities, loan EMIs, and transport costs.

- Multiply that figure by three for the minimum and by six for the ideal safety net.

- Write this number down — this becomes your savings target and keeps you motivated.

Step 2 – Start Small and Automate Savings

Don’t worry if your savings capacity is limited in the beginning — consistency matters more than size.

- Open a dedicated savings account exclusively for emergencies. This prevents mixing daily spending with your safety net.

- Automate the process by scheduling transfers — even if it’s just 5–10% of your income every month.

- If you’re unsure how much you can set aside, revisit our guide on the 50/30/20 Rule Explained to understand how to allocate your income smartly.

Step 3 – Cut Expenses and Redirect Savings

The easiest way to grow your emergency fund faster is by redirecting small leaks in your budget.

- Cancel subscriptions you no longer use.

- Limit eating out or impulse purchases.

- Redirect every rupee or dollar saved directly into your emergency fund account.

For more practical ways to trim expenses, check out our upcoming guide on Best Money-Saving Habits That Actually Work.

Step 4 – Choose the Right Place to Keep It

Where you keep your emergency fund is just as important as how much you save. The money should be safe, liquid, and accessible.

- A high-interest savings account works best for quick access.

- Fixed deposits (FDs) with short tenures can be an option if you want slightly higher returns.

- Money market funds are another low-risk, liquid alternative.

Just remember — your emergency fund is not for long-term investing. For smarter strategies with fixed deposits, see our guide on FD Laddering Strategy: Maximize Returns and Liquidity.

Step 5 – Replenish After Use

An emergency fund is like a financial shield — it works only if it’s maintained.

- Use it only for genuine emergencies like medical bills, job loss, or urgent repairs.

- Once you dip into it, rebuild immediately by restarting your savings transfers until you’re back to your target.

Where NOT to Keep Your Emergency Fund

When it comes to your emergency savings, liquidity and safety matter more than high returns. Many beginners make the mistake of chasing higher interest rates or investing their emergency fund in risky assets. Here’s where you should avoid keeping it:

1. Stocks

The stock market is designed for long-term growth, not short-term emergencies. Prices fluctuate daily, and if you’re forced to sell during a market downturn, you could end up withdrawing much less than what you saved. An emergency fund must always be stable and accessible, not exposed to volatility.

2. Cryptocurrencies

Crypto assets are even more unpredictable than stocks. While they might promise big gains, their value can also drop sharply overnight. On top of that, liquidity issues (like exchange downtimes or withdrawal restrictions) make crypto a poor choice for money you might need instantly.

3. Long-Term Fixed Deposits (FDs)

Fixed deposits are popular for safe savings, but long-term FDs lock your money for years. If you break an FD before maturity, you’ll face penalties and lose interest benefits. That defeats the purpose of having quick cash for emergencies. If you want to use an FD, keep it short-term and only if you can access it without penalties.

Pro Tip: The best place for an emergency fund is a separate savings account or a money market account—easy to access, low risk, and offering some interest to protect against inflation.

Common Mistakes to Avoid

Building an emergency fund is simple in theory, but many beginners make small mistakes that can weaken the purpose of this safety net. Here are the three most common errors you should steer clear of:

1. Mixing Your Emergency Fund with Investment Accounts

An emergency fund should always be liquid and easy to access. Keeping it in the same account as your stock portfolio, mutual funds, or long-term fixed deposits creates two risks:

- You may be tempted to withdraw money for non-emergency goals.

- Market fluctuations could reduce the amount right when you need it most.

Better Approach: Keep your emergency fund in a separate high-liquidity savings account or money market fund so it remains untouched and safe.

2. Overfunding: Hoarding Cash Instead of Investing

Saving too much in an emergency fund can backfire. While cash is safe, it generates very little return. Once you’ve built the recommended 3–6 months of living expenses, putting excess money into an emergency account means you’re missing out on potential growth through investments.

Better Approach: After reaching your emergency goal, direct extra savings toward long-term investments such as mutual funds, index funds, or retirement accounts. This balances safety with wealth-building.

3. Ignoring Inflation

One hidden mistake is forgetting the impact of inflation. If you park money in an account with low or no interest, its real value decreases over time. For example, ₹1,00,000 saved today may not cover the same expenses five years later.

Better Approach: Choose a savings account or short-term deposit that at least keeps pace with inflation. Reassess your emergency fund every year to adjust for rising costs.

By avoiding these mistakes, your emergency fund will stay reliable, accessible, and truly serve as the financial cushion it’s meant to be.

Conclusion

An emergency fund isn’t just about saving money—it’s about protecting your future. By setting aside even a small amount each month, you create a safety net that shields you from debt, stress, and financial setbacks. Whether it’s a medical bill, job loss, or an unexpected expense, having 3–6 months of living costs saved ensures you can stay secure without disrupting your long-term goals.

The key is to start today, no matter how small the amount. With consistency, discipline, and the right strategy, your emergency fund becomes the foundation of financial stability—helping you build confidence and focus on bigger financial goals.

Frequently Asked Question

1. How much should I save if I earn a low income?

If you’re on a low income, start small. Even ₹500 or $20 a month adds up over time. The goal is consistency, not perfection. Begin with a target of one month’s expenses, then gradually build toward 3–6 months as your income grows.

2. Can I use credit cards instead of an emergency fund?

No. Credit cards are debt and come with high interest rates. An emergency fund gives you cash you already own, so you don’t spiral into debt during a crisis. You can use credit cards for convenience, but never as a substitute for savings.

3. Should I keep emergency funds in multiple accounts?

Yes, but keep it simple. Many people split funds between:

- A savings account (instant access).

- A short-term fixed deposit or money market account (for better returns).

This ensures liquidity plus growth, but avoid spreading into too many accounts.

4. Is ₹1 lakh / $1,000 enough as a starter fund?

Yes, as a starter fund. For many individuals, ₹1 lakh in India or $1,000 in the US covers small emergencies like medical bills, car repairs, or appliance breakdowns. But long term, aim for 3–6 months of expenses, which could mean ₹3–6 lakhs or $5,000–$15,000 depending on your lifestyle.

5. Can I invest part of my emergency fund?

It’s not recommended. An emergency fund should stay in low-risk, highly liquid places like savings accounts or money market funds. Investments like stocks or crypto can lose value or be hard to withdraw quickly. Once you’ve built your fund, invest extra savings separately.

6. Where should I keep my emergency fund?

The best options are:

- High-yield savings accounts.

- Money market funds.

- Short-term deposits.

Choose safety and easy access over high returns.

7. How long does it take to build an emergency fund?

It depends on income and savings discipline. Some people take 6–12 months, others 2–3 years. Focus on steady contributions, even if small. Automating savings makes it faster.

8. Can I use my emergency fund for planned expenses like vacations?

No. Planned expenses should have a separate sinking fund. Your emergency fund is only for unexpected events like job loss, medical emergencies, or urgent repairs.

9. What’s the difference between an emergency fund and regular savings?

- Emergency fund = reserved only for sudden, unavoidable expenses.

- Regular savings = money for goals like travel, gadgets, or investments.

Mixing the two makes it harder to track and may leave you unprepared in real emergencies.

10. Should couples have a joint or separate emergency fund?

Both approaches work:

- Joint fund for shared expenses (rent, household, kids).

- Separate funds for personal emergencies.

Many couples keep a joint emergency fund for stability, while maintaining individual accounts for independence.