India’s tax landscape is undergoing one of its most significant reforms since the introduction of the Goods and Services Tax (GST) in 2017. Finance Minister Nirmala Sitharaman has announced a simplified GST structure—dubbed GST 2.0—that reduces the complex four-slab system to just two main rates: 5% and 18%, along with a 40% “sin tax” for luxury and harmful goods. From September 22, 2025, consumers will see daily essentials like soap, toothpaste, and shampoo move into the lower bracket, while electronics and vehicles are streamlined at 18%. At the same time, luxury cars, tobacco, and other premium goods will attract a higher tax burden.

The move is being positioned as a Diwali gift to households and businesses, promising greater transparency, easier compliance, and relief for millions of consumers. But beyond festive discounts, this reform could also reshape India’s indirect tax system for the long term.

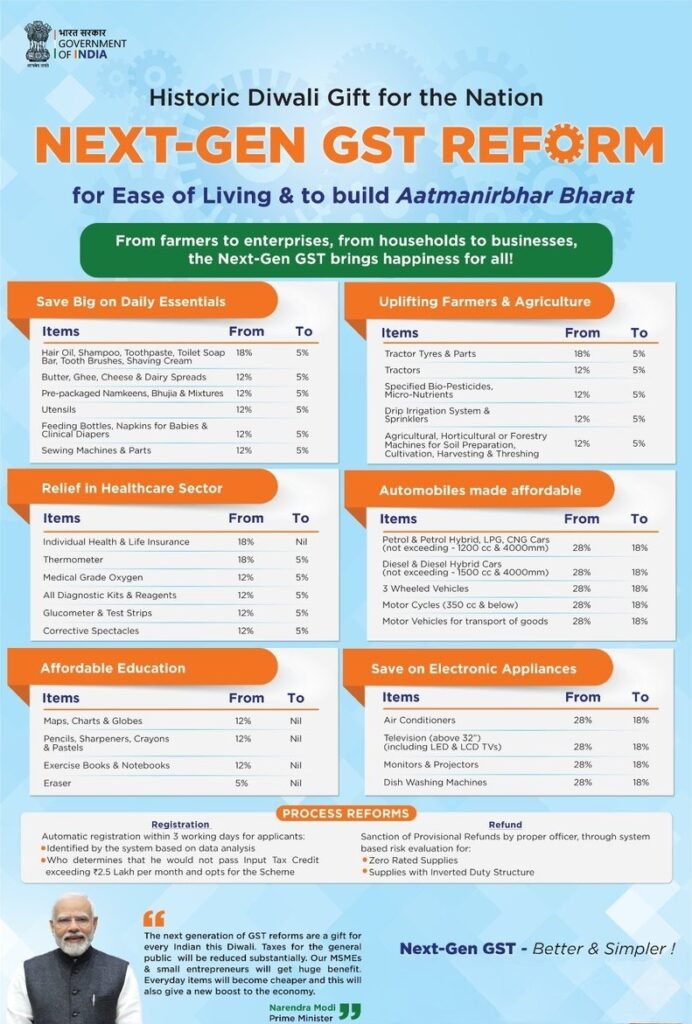

Understanding GST 2.0 Reform

Old GST Structure vs the New Simplified Slabs

Since its rollout in 2017, the Goods and Services Tax (GST) in India operated on a multi-slab structure: 0%, 5%, 12%, 18%, and 28%, with an additional cess on sin and luxury goods. While this helped accommodate diverse categories of products, it also created complex compliance challenges for businesses and confusion among consumers.

With GST 2.0, Finance Minister Nirmala Sitharaman announced a major simplification:

- 5% slab: Daily essentials such as soap, toothpaste, shampoo, basic insurance, tractors, and select FMCG goods.

- 18% slab: Standard goods and services like televisions, air conditioners, small cars, and most electronics.

- 40% slab (sin tax): Luxury cars, cigarettes, and harmful products.

This streamlined model reduces ambiguity, makes billing simpler, and provides consumers with greater clarity on what they pay.

Why the Government Chose to Streamline GST Now

The decision to rationalize GST comes after years of industry demand for a simpler tax regime. The earlier system often resulted in rate disputes, classification confusion, and compliance burdens. By cutting down slabs, the government aims to:

- Boost consumer confidence with transparent pricing.

- Ease compliance for small and medium businesses, many of which struggled under the old structure.

- Encourage consumption during a period when the Indian economy seeks to strengthen domestic demand and counter inflationary pressures.

This reform also aligns India closer to global tax norms, where fewer slabs and simpler rates are the norm.

Political and Economic Context (Pre-Diwali Consumer Relief)

The timing of GST 2.0 is as strategic as it is economic. Rolling out the reform in September 2025, just ahead of the Diwali festive season, ensures maximum political goodwill and consumer impact. By lowering the GST on essentials and commonly purchased goods, the government offers families immediate savings during the year’s peak shopping period.

For the ruling government, this move doubles as a popular pre-festival relief package, enhancing its pro-consumer image while addressing middle-class concerns over rising costs. On the economic front, the hope is that higher festive spending will support GDP growth, bolster retail demand, and provide a much-needed consumption push before the next Union Budget.

Also Read: Best Money-Saving Habits That Actually Work (Global Edition)

Key GST Slabs Explained

5% Slab — Daily Essentials

These items fall under the lowest GST slab, making them more affordable for households:

| Item Category | Examples | Impact on Consumers |

|---|---|---|

| Personal Care | Toothpaste, soap, shampoo | Daily hygiene costs reduce, especially for FMCG-heavy families. |

| Agriculture | Tractors, basic farm machinery | Lower input costs for farmers → improved rural demand. |

| Insurance | Health & life insurance premiums | Relief for middle-class policyholders, encouraging higher insurance adoption. |

| Other Essentials | Household cleaning supplies | Adds relief to monthly budgets on frequently purchased goods. |

18% Slab — General Goods

This mid-level slab covers most durable goods and non-essentials.

| Item Category | Examples | Impact on Consumers |

|---|---|---|

| Electronics | TVs, air conditioners, washing machines | Big-ticket household items more affordable, aiding festive sales. |

| Automobiles | Small cars, two-wheelers | Mid-range vehicle buyers see meaningful savings. |

| Appliances | Mixers, refrigerators, microwaves | Boosts demand during festivals with lower upfront costs. |

| Lifestyle Products | Furniture, kitchenware, decor | Improves discretionary spending power. |

40% Slab — Sin & Luxury Goods

The highest slab is aimed at discouraging harmful or luxury consumption.

| Item Category | Examples | Impact on Consumers |

|---|---|---|

| Tobacco Products | Cigarettes, cigars, chewing tobacco | Heavy tax burden to discourage usage; prices rise significantly. |

| Luxury Vehicles | Premium SUVs, high-end sedans | Wealthy buyers absorb higher tax; luxury market growth slows. |

| Premium Goods | Branded alcohol, luxury watches, imported luxury appliances | Stronger sin/luxury tax means these become status-driven buys, not mass market. |

Impact on Consumers & Businesses

Household savings during the festive season

The simplified GST structure is expected to put more money back into household budgets just in time for Diwali shopping. Everyday essentials like soap, shampoo, toothpaste, and even insurance premiums now fall under the 5% slab, translating to direct savings on monthly expenses. Families planning to buy appliances, smartphones, or small cars under the 18% bracket may also benefit from reduced costs compared to previous higher slabs. With millions of households preparing for festival spending, these rate cuts could amplify consumer demand and encourage families to stretch their budgets further without overspending.

Relief for small businesses and compliance benefits

For small traders and MSMEs, GST 2.0 offers simplified compliance. The reduction from multiple slabs to two broad categories (5% and 18%) means less confusion in billing, accounting, and filing returns. This move could free up time and resources for small businesses to focus on operations rather than tax classification disputes. Additionally, industries like FMCG, retail, and insurance stand to benefit from a lower tax burden, potentially passing these savings on to end consumers. Over time, simplified compliance could also reduce litigation and increase ease of doing business in India.

Market reactions and industry response

The immediate response from markets has been largely positive. FMCG stocks and auto companies—both sectors expected to benefit from lower GST—saw an uptick in early trading sessions after the announcement. Analysts suggest that the GST cut could spur domestic demand and accelerate India’s consumption-led growth. Meanwhile, luxury and tobacco manufacturers facing a steep 40% sin tax have expressed concerns about reduced margins and potential demand slowdown. Overall, industry groups welcomed the clarity and predictability that comes with fewer tax slabs, noting that this reform marks a step toward a simpler, investor-friendly tax regime.

What Consumers Should Do

The GST reform has created both excitement and confusion for households and businesses. With new slabs coming into effect on September 22, 2025, many families are wondering whether to advance purchases or wait, how to revise budgets, and what the long-term economic effects might be.

Buy Now or Wait Till Sept 22 for Benefits?

For everyday essentials like soap, shampoo, toothpaste, and insurance services, the new 5% GST slab will bring noticeable savings. Consumers planning to stock up on household goods may benefit by waiting until September 22, when prices officially reflect the lower tax.

For high-ticket items—like air conditioners, TVs, and cars—currently falling in the new 18% slab, it may be wiser to delay purchases until post-implementation. Retailers are already preparing festive discounts, which, combined with GST relief, could translate to significant Diwali savings.

However, if you need immediate purchases, check with retailers. Some brands may pass on GST relief early to attract shoppers, while others may only revise pricing after the official rollout.

How to Adjust Household Budgets

The simplified GST structure means that households can reallocate monthly budgets more effectively:

- Reduce allocation for essentials: Lower tax rates on daily goods and insurance mean families can cut spending here, freeing cash for savings or investments.

- Increase discretionary spending: Electronics and consumer durables will be taxed at 18%, lower than earlier slabs. Families may safely budget for festive purchases without overspending.

- Plan for big-ticket buys: Cars, high-end gadgets, and lifestyle products in the 18% slab should be scheduled post-Sept 22 for maximum savings.

For middle-class households, this is an opportunity to stretch disposable income, while small business owners can streamline tax compliance and reinvest savings.

Long-Term Inflationary Effects

While GST 2.0 brings immediate relief, the long-term impact on inflation depends on how businesses respond.

- Positive side: With lower compliance costs and simpler slabs, retailers may pass savings to customers, keeping consumer inflation in check.

- Neutral to negative side: The new 40% sin tax on luxury items and tobacco could raise the overall price index in those segments, indirectly influencing lifestyle inflation.

- Balanced effect: Over time, the government expects the simplified GST to boost compliance, reduce litigation, and stabilize revenue, which may help manage inflation more consistently.

For consumers, the key takeaway is to enjoy immediate cost benefits on essentials and mid-range goods, but remain cautious about luxury spending as prices in that category could rise further

Conclusion

The GST 2.0 reform announced by Finance Minister Nirmala Sitharaman is more than just a rate adjustment—it’s a step toward simplification, compliance ease, and consumer relief. With essentials like soap, shampoo, and insurance now in the 5% bracket, and high-value items taxed at 18% or 40%, households can expect tangible savings ahead of the festive season.

For businesses, this streamlined structure reduces compliance headaches and helps stabilize pricing strategies. For consumers, it creates clarity on where money goes, making budgeting and festive planning easier.

As these changes roll out from September 22, 2025, the smart move is to plan purchases accordingly—whether upgrading appliances, buying a car, or simply stocking up on essentials. By aligning personal budgets with the new GST slabs, both families and businesses can maximize benefits while staying prepared for long-term economic shifts.

In short: GST 2.0 is not just a festive relief—it’s a structural reset for India’s tax system.

Frequency Asked Questions

1. What is the new GST structure in India 2025?

The GST Council has simplified slabs into just two main rates—5% and 18%—along with a special 40% “sin tax” for luxury and harmful goods. This reform, announced by Finance Minister Nirmala Sitharaman, replaces the older four-tier system.

2. Which products fall under the 5% GST category?

Daily essentials such as toothpaste, soap, shampoo, insurance premiums, tractors, and certain household necessities are taxed at 5%. This move is aimed at making basic goods more affordable for households.

3. What items are now taxed at 18%?

Most consumer durables and general goods fall under the 18% slab. This includes televisions, air conditioners, small cars, and common appliances. It’s designed to balance affordability with revenue collection.

4. What does the 40% “sin tax” apply to?

The new 40% GST slab applies to tobacco products, luxury cars, and other premium or harmful goods. The aim is to discourage consumption of unhealthy or high-luxury items while raising revenue for public health initiatives.

5. From when will the new GST rates be effective?

The revised GST slabs will come into effect on September 22, 2025. Businesses are expected to update their billing and compliance systems before this date.

6. How will GST 2.0 impact household budgets?

For many families, essential items will get cheaper, leading to direct savings on monthly expenses. However, households purchasing premium goods or luxury cars may feel the impact of the new 40% rate.

7. What does this mean for small businesses?

Small retailers and SMEs benefit from a simpler compliance structure with fewer slabs. It reduces confusion, makes filing easier, and helps them compete better during the festive season.

8. Will GST 2.0 affect inflation in India?

Experts believe that while essentials may become cheaper, the higher tax on luxury and sin goods could balance out the impact. The reform is not expected to create major inflationary pressure overall.

9. Is insurance now completely GST-free?

Yes. One of the big highlights is that insurance premiums are exempt from GST under the new structure, making coverage more affordable for consumers.

10. Should I make big purchases before or after the GST reform?

If you’re planning to buy essentials or insurance, waiting until after September 22 could save money. However, for luxury items like big cars or tobacco, it may be cheaper to buy before the new 40% rate applies.