Filing your Income Tax Return (ITR) isn’t just a legal requirement—it’s also the key to unlocking financial benefits like faster refunds, smoother loan approvals, and accurate income records. For millions of taxpayers in India, the ITR season is an opportunity to stay compliant while making the most of eligible deductions and refunds.

For Assessment Year (AY) 2025–26, the government has introduced some important updates that every individual, salaried professional, and business owner should know. From revised tax slabs to new compliance measures, staying informed can save you both time and money.

If you’re starting your personal finance journey and want to build a strong foundation beyond taxes, don’t miss our guide on Top 25 Personal Finance Tips Everyone Should Know in 2025.

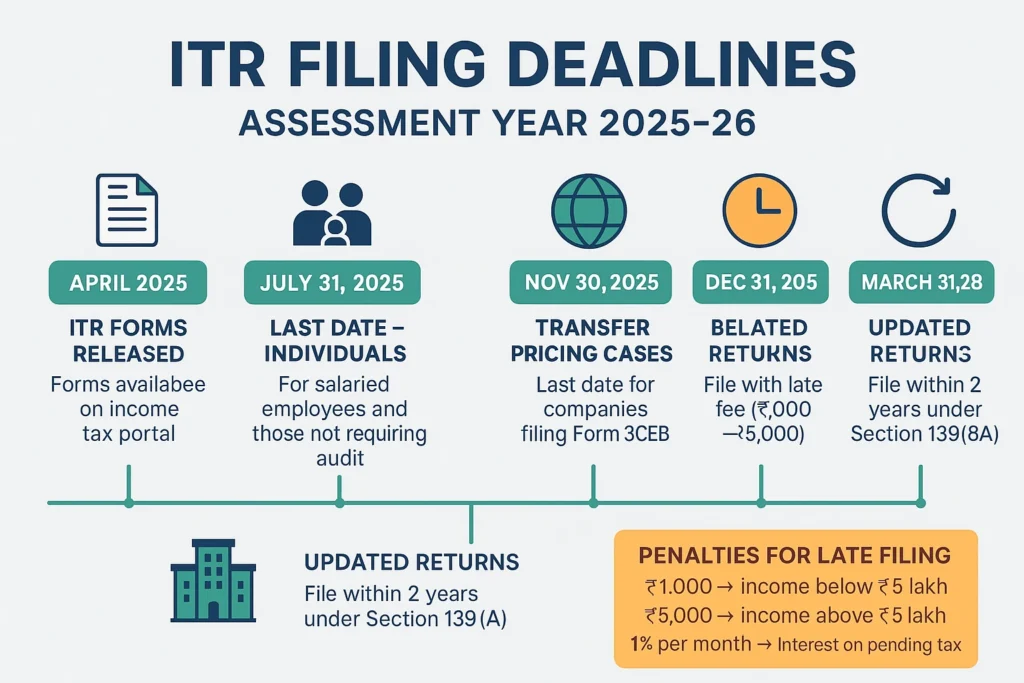

ITR Filing Deadlines for AY 2025–26

When it comes to income tax returns, missing the deadline can mean losing refunds and paying avoidable penalties. For Assessment Year (AY) 2025–26, the Income Tax Department has released the key dates that every taxpayer should keep in mind.

Important Dates for ITR Filing

- Individuals & Salaried Employees (not requiring audit):

July 31, 2025 – Last date to file ITR. - Businesses/Professionals requiring audit:

October 31, 2025 – Deadline for audited return filing. - Companies requiring transfer pricing report (Form 3CEB):

November 30, 2025 – Last date to file ITR. - Belated/Updated Returns:

- Belated return: Can be filed until December 31, 2025 with late fee.

- Updated return (u/s 139(8A)): Can be filed within 2 years from the end of AY (i.e., until March 31, 2028).

Pro Tip: File early to avoid last-minute rush, portal slowdowns, or document mismatches.

Penalties for Late Filing

If you miss the July 31 deadline:

- ₹1,000 penalty – For taxpayers with income below ₹5 lakh.

- ₹5,000 penalty – For taxpayers with income above ₹5 lakh.

- Additional Interest (1% per month) – On unpaid tax under Section 234A.

- Loss Carry Forward Restrictions: Certain business or capital losses cannot be carried forward if the return is filed late.

Even if your income is below the taxable limit, timely filing is advised to claim refunds or maintain financial records for loans and visas.

Documents Required for ITR Filing (AY 2025–26)

Before you start filing your Income Tax Return, keeping the right documents ready will make the process smooth and error-free. Missing even one document can delay your filing or cause discrepancies in your return. Here’s a checklist of the essential documents you should gather:

1. Permanent Account Number (PAN)

Your PAN is mandatory for filing ITR in India. Ensure your PAN is active and correctly linked with your Aadhaar to avoid rejection.

2. Aadhaar Card

The government has made Aadhaar mandatory for e-verification. Linking your PAN with Aadhaar also helps in faster processing of your return.

3. Form 16

Issued by your employer, Form 16 summarizes your salary income and TDS deducted. Salaried employees will need this to file accurately.

4. Form 26AS

This consolidated tax statement shows the taxes deducted at source, advance tax, and self-assessment tax paid. You can download it directly from the income tax portal.

5. Annual Information Statement (AIS)

AIS is a detailed report introduced by the Income Tax Department that includes your savings interest, dividends, securities transactions, and high-value financial activity. Cross-check your AIS carefully to ensure nothing is missed.

6. TDS Certificates

If you have income from sources other than salary (like fixed deposits, rent, or professional income), the respective deductor will issue a TDS certificate (Form 16A or others). Keep these ready for accurate reporting.

7. Bank Interest Certificates & Investment Proofs

Collect interest certificates from banks and post offices for savings, fixed, or recurring deposits. Also, gather proofs of tax-saving investments (ELSS, PPF, LIC premiums, home loan certificates) to claim deductions.

💡 Pro Tip: Keeping a record of your monthly and yearly expenses can make tax filing easier. A well-structured budget also helps you plan tax-saving investments better. Check out our guide on the Budget Planner Guide: How to Create a Monthly Spending Plan for practical tips.

Types of ITR Forms (AY 2025–26)

When filing your income tax return, choosing the correct ITR form is the first and most important step. The Income Tax Department of India has notified multiple forms, but for most individuals and small businesses, the relevant ones are ITR-1, ITR-2, ITR-3, and ITR-4. Filing with the wrong form can make your return invalid.

Below is a clear breakdown of each form and who should use it in AY 2025–26:

1. ITR-1 (Sahaj)

- Who can file?

- Resident individuals with income up to ₹50 lakh.

- Sources: salary, one house property, and other income (like interest).

- Who cannot file?

- Individuals with capital gains, income from business/profession, or foreign income/assets.

- Example: A salaried professional earning ₹12 lakh per year with FD interest can file ITR-1.

2. ITR-2

- Who can file?

- Individuals and HUFs not having income from business/profession.

- Sources: salary, multiple house properties, capital gains, foreign income, agricultural income > ₹5,000.

- Who cannot file?

- Individuals with income from business or profession.

- Example: An IT employee earning ₹20 lakh salary + capital gains from selling shares must file ITR-2.

3. ITR-3

- Who can file?

- Individuals and HUFs having income from business or profession.

- Also includes income from salary, house property, capital gains, and other sources.

- Who cannot file?

- Not applicable to companies or firms (they have separate forms).

- Example: A freelance consultant with ₹15 lakh professional income + ₹2 lakh salary income files ITR-3.

4. ITR-4 (Sugam)

- Who can file?

- Resident individuals, HUFs, and firms (other than LLP) with total income up to ₹50 lakh.

- Having income from business/profession under presumptive taxation scheme (Sections 44AD, 44ADA, 44AE).

- Who cannot file?

- Individuals with foreign income, capital gains, or if turnover exceeds ₹2 crore.

- Example: A small shop owner declaring ₹25 lakh turnover under presumptive taxation files ITR-4.

Common Mistakes to Avoid in ITR Filing

Even small errors while filing your Income Tax Return (ITR) can lead to notices, penalties, or delayed refunds. Here are the most common mistakes you should watch out for in AY 2025–26:

1. Filing the Wrong ITR Form

Each ITR form is designed for a specific income type and category of taxpayer. For example, salaried individuals usually file ITR-1 or ITR-2, while business owners may need ITR-3 or ITR-4. Choosing the wrong form can make your return invalid. Always double-check your eligibility before starting the process.

2. Missing Out on Income Sources

Many taxpayers forget to report income beyond salary. This includes:

- Bank interest from savings or fixed deposits.

- Freelance or side hustle earnings.

- Capital gains from stocks, mutual funds, or even crypto assets.

Leaving these out can trigger mismatch alerts in Form 26AS or AIS, leading to notices from the Income Tax Department.

3. Not Verifying the Return

Submitting your ITR isn’t the last step. You must verify it within 30 days (via Aadhaar OTP, net banking, or other methods). If you don’t, your return will be treated as not filed. This could mean losing refunds and even facing penalties.

Why Avoiding Mistakes Matters

Errors in ITR filing often create unnecessary stress and financial setbacks. For instance, missing income details might push you into unexpected tax dues, leading to debt. If you’re already struggling with repayments, here’s a helpful read on How to Get Out of Debt Fast: Proven Debt Repayment Strategies.

After Filing: What Happens Next?

Filing your Income Tax Return is only the first step. Many taxpayers believe the process ends once they click “Submit,” but there are important post-filing stages you should know about.

1. Processing by CPC

After you e-verify your return, it goes to the Centralized Processing Centre (CPC) in Bengaluru. The system cross-checks your declared income, TDS, and deductions with the data from Form 26AS and AIS. If everything matches, the ITR is processed smoothly. If discrepancies are found, you may receive a notice under Section 143(1) for clarification.

2. Refund Timeline

If you are eligible for a refund, CPC usually issues it within 20–45 days of processing. The amount is credited directly to your bank account linked with your PAN. To avoid delays, make sure your bank account is pre-validated on the e-filing portal. Refunds may take longer if there are mismatches or if your return is selected for detailed scrutiny.

3. Rectification Process

Sometimes, errors slip through while filing—like entering the wrong bank details or forgetting to claim a deduction. In such cases, you can file a rectification request under Section 154 on the e-filing portal. This option allows you to correct mistakes without penalties, as long as they are genuine and not attempts at misreporting.

💡 If you’ve filed your ITR and are waiting for a refund, this is also a good time to revisit your broader financial health. For instance, if you’re planning big purchases or managing debt, you may want to explore your credit options. Check out our detailed guide on Personal Loan vs. Credit Card Loan: Which One Should You Choose? to make informed borrowing decisions.

Quick Reference: ITR Filing AY 2025–26

For AY 2025–26, the last date to file Income Tax Returns for individuals is July 31, 2025 (unless extended). Salaried taxpayers usually file ITR-1 or ITR-2, while business owners and professionals may need ITR-3 or ITR-4. Keep essential documents ready—PAN, Aadhaar, Form 16, Form 26AS, AIS, and investment proofs.

Filing is simple: log in to the e-filing portal, choose the correct form, review pre-filled details, declare income, claim deductions, and e-verify your return. Filing before the deadline avoids penalties and ensures faster refunds.

Conclusion: File Early, Save More

Filing your Income Tax Return for AY 2025–26 doesn’t have to be stressful. By keeping your documents ready, choosing the right ITR form, and understanding available deductions, you can avoid penalties and even maximize your refunds. The earlier you file, the smoother the process—plus, you’ll have time to fix errors if needed.

Before you hit “submit,” take a few minutes to explore ways you can legally save more on taxes. Our free Tax Saving Estimator Tool helps you quickly calculate potential savings and plan smarter investments for the year ahead.

And if you’re also managing loans or planning a big purchase, don’t miss our Best EMI Calculator Tools Online: Compare Loans Before Borrowing to check how your monthly finances stack up.

👉 Act now, file before the deadline, and make your money work smarter for you.

Frequently Asked Questions

1. When is the last date to file ITR for AY 2025–26?

The last date to file your income tax return for AY 2025–26 is 31st July 2025 for most individual taxpayers. If you miss this deadline, you can still file a belated return until 31st December 2025, but late fees and interest may apply.

2. Which ITR form should salaried employees use for AY 2025–26?

Most salaried employees with a total income up to ₹50 lakh and income from salary, one house property, and other sources (like interest) should use ITR-1 (Sahaj). If you have capital gains, multiple house properties, or foreign assets, you’ll need to use ITR-2 instead.

3. Can I file ITR without Form 16?

Yes, you can file your ITR even if your employer has not issued Form 16. You will need to use Form 26AS, AIS (Annual Information Statement), and your salary slips to calculate income, TDS, and taxes paid.

4. What happens if I miss the ITR filing deadline?

If you miss the deadline, you can still file a belated return until 31st December 2025. However, late filing fees under Section 234F (up to ₹5,000) and interest on unpaid taxes will apply. You may also lose the chance to carry forward certain losses.

5. How long does it take to get an ITR refund?

Once your return is processed by the Centralized Processing Centre (CPC), refunds are usually credited to your bank account within 20–45 days. Ensure your bank account is pre-validated on the e-filing portal to avoid delays.

6. Is it mandatory to file ITR if my income is below ₹2.5 lakh?

If your total income is below the basic exemption limit (₹2.5 lakh for individuals below 60 years), you are not required to file ITR. However, filing is advisable if you want to claim a refund, carry forward losses, or show financial proof for loans or visas.

7. Can I revise my ITR after filing?

Yes, you can revise your ITR if you discover mistakes or omissions after filing. For AY 2025–26, revised returns can be filed up to 31st December 2025, as long as the original return was filed within the deadline.

8. Do I need to e-verify my ITR?

Yes, e-verification is mandatory for ITR filing to be considered complete. You can e-verify using Aadhaar OTP, net banking, DEMAT account, or ATM PIN. If you prefer physical verification, you can send a signed ITR-V form to CPC Bangalore.

9. Can freelancers and gig workers file ITR online?

Yes, freelancers, gig workers, and self-employed individuals must file ITR if their income exceeds ₹2.5 lakh. They usually file using ITR-3 or ITR-4 (Sugam) under the presumptive taxation scheme if opting for simplified tax reporting.

10. What are the penalties for incorrect ITR filing?

If your ITR contains inaccurate details, you may face penalties under the Income Tax Act. Minor errors can be corrected through revision, but willful misreporting (like hiding income) can attract penalties of 50–200% of the tax avoided.